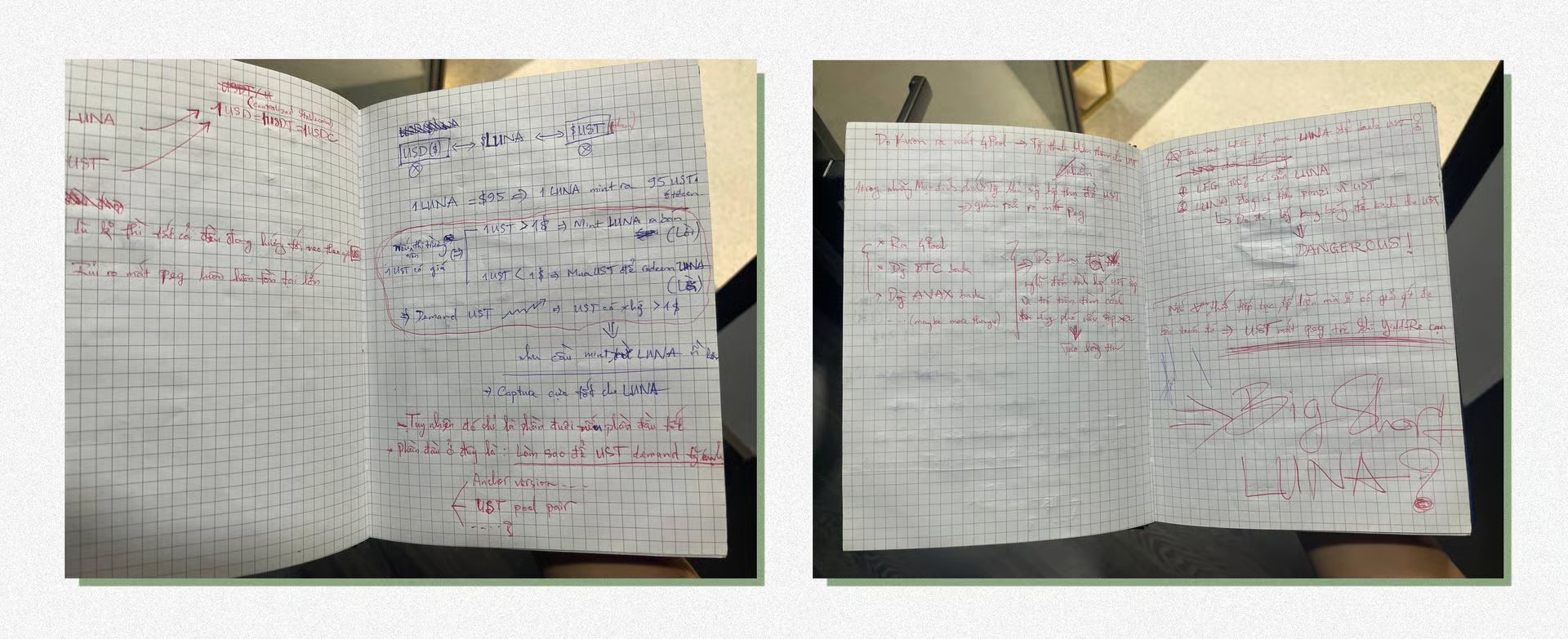

Instead of opening with a quote as usual, this week I want to share something else with you: four pages from an old notebook that I recently rediscovered while reorganizing my bookshelf. They tell the story of my “Big Short LUNA.”

LUNA and UST were the two tokens of the once-famous Terra project. LUNA was the token of the ecosystem, while UST was an algorithmic stablecoin backed by LUNA itself rather than being fiat-backed 1:1 with USD like most traditional stablecoins.

With a fixed yield of 20%, the model had long been flagged as unsustainable. Yet at that time, only a handful of people in the crypto market believed that LUNA could actually collapse.

After analyzing the model and its surrounding factors, I became convinced that LUNA was highly likely to fail. I even wrote an article titled “Waiting for a Big Short on LUNA” on MarginATM. And then?

Everything happened exactly as expected, except for one thing: my Big Short never did.

Why?

Because when LUNA actually started to fall, I lost my conviction. I stopped trusting my own analysis. I was influenced by narratives like “Terra has massive backing,” or “So many powerful players are behind it, how could it possibly collapse?”

The result: LUNA and UST collapsed, Do Kwon went to jail, many large players lost billions of dollars, while my Big Short existed only on paper. I ended up making just a few hundred dollars as consolation from a late short position.

It all came down to two simple words: conviction.

That became a major lesson for me. Having the courage to believe in your own thinking, and to think differently from what others believe, is one of the most profound lessons I’ve personally learned.

Of course, conviction must be rational. It has to be grounded in logic and thorough analysis, not blind belief or something you accept just because someone else said it and it sounds reasonable. That kind of belief is fragile, easily shaken, and often leads to poor decisions.

Much like how the market has moved over the past week, our job is to remain steady and committed to what we’ve already analyzed, at least until a sufficiently large variable appears that changes the entire market structure. Only then should conviction be reassessed.

So, what stood out this week?