One thing that’s easy to observe when comparing today’s crypto market to five years ago is fragmentation. We now have:

A large number of blockchains

Dozens of ecosystems, big and small

Each ecosystem spawning multiple sectors and sub-sectors

According to CoinMarketCap, the market now tracks over 20 million coins and tokens, compared to roughly 20,500 in 2021. Yes, many of these are memecoin but that only reinforces the point: Capital today is far more fragmented than before.

→ And fragmentation means two things:

You need to look much more carefully to find real opportunities.

Not every ecosystem, and not every project, has equal odds.

That reality is what led me to Solana.

To be clear: I think opportunities will not exist only on Solana. But Solana may be one of the few places where good opportunities actually have room to form.

In future pieces, I’ll explain why that “few” matters.

For now, this article focuses on Solana.

Why Solana Still Has a Real Chance

Before searching for opportunities within any ecosystem, I always ask one core question: Why could opportunities exist here in the first place?

After observing the market, these are the key reasons I believe Solana still has a real chance:

1. Solana Has Reclaimed a Top-Tier Position:

Memecoin are not new. But Solana was the first chain to experience explosive growth because of memecoin. Even though the memecoin wave has cooled significantly, you cannot deny its impact:

It brought attention back to Solana.

It helped Solana recover from the post-FTX collapse (from ~$8).

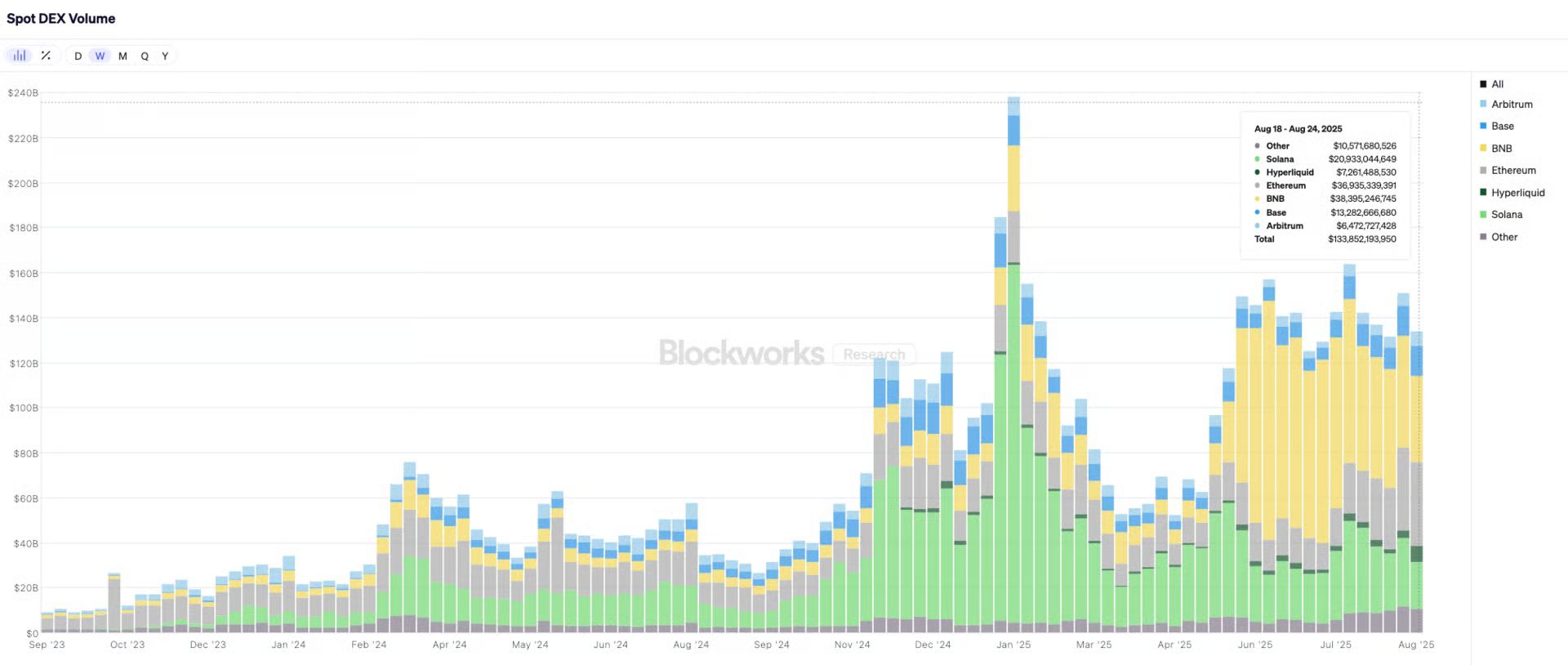

Today, Solana and Ethereum are effectively the only two ecosystems competing for #1 in trading volume.

To be clear: Memecoin dominance is not a Solana-only problem. Retail traders across the entire market largely trade meme because they don’t know what else to trade.

So it’s not surprising that the market feels “all meme” right now.

(BNB Chain excluded here due to distorted volume from Binance Alpha point farming.)

2. Solana Is Where Real Activity Happens

If you look at TVL, Ethereum is still clearly #1 and maintains a large gap over the rest. But TVL alone doesn’t tell the full story. Capital that sits idle, locked in DeFi without active usage, is not being utilized efficiently. If you measure capital velocity and activity, Solana is currently outperforming Ethereum.

From (1) and (2), these data points show something important:

Solana has users.

Those users have reasons to be there.

They are actively using the ecosystem.

And now let’s come to the third component.

3. Leadership Equals Revenue:

Because of this user activity, Solana has now led the market in ecosystem revenue for 23 consecutive weeks. You can think of Solana like:

A country rich in natural resources, but still early in development

Or a country with strong demand and purchasing power, waiting for the right supply

In a market where many chains lack users, liquidity, or capital flow, Solana is signaling that: It already has the environment needed for builders to come in, ship products, and generate real revenue.

4. Internet Capital Market Is Not a Meme Narrative

Internet Capital Market (ICM) is not a memecoin trend or a temporary narrative. It is the original vision of Toly, Solana’s founder to turn Solana into the best possible environment for financial activity - essentially a decentralized Nasdaq.

If crypto is ever going to reach mass adoption, it will need:

A highly optimized trading environment.

Low latency.

Low fees.

High throughput.

Reliability during extreme demand.

Solana has now demonstrated 18 months of continuous uptime, even under extreme stress: Massive volume spikes, Liquidity concentration events, Meme-driven trading frenzy.

Transaction fees remained: ~1500× cheaper than Ethereum and ~3.6× cheaper than Base. And the chain kept running.

This matters.

When something is a core vision, not a marketing slogan, the team will do everything possible to make it real: Technology, Infrastructure, Go-to-market execution.

And I think this is where opportunities are born.

5. Solana Is Becoming More Competitive

Solana still has meaningful upgrades queued between now and 2027. One of the most important near-term upgrades is BAM, developed by the Jito team, expected to go live within 1–3 months. In simple terms, BAM addresses one of Solana’s biggest historical weaknesses: Prioritized cancels for on-chain orderbooks (CLOB).

This limitation previously made it difficult for: Market Maker to operate efficiently Spot/Perp to compete with CEX.

Without prioritized cancels, Market Maker cannot quickly cancel unfavorable orders → Risk increases → Spreads widen → Trader get worse execution.

That is one of the biggest problems of Solana and in the next months, BAM directly solves this problem.

It also introduces Application Controlled Execution, allowing application to better control transaction ordering - reducing the need for projects to leave Solana and build their own chain just to get performance and economic control.

After Meme, What Comes Next?

After the recent explosive memecoin wave, Solana gained:

Users

Capital

Liquidity already sitting on-chain

Now the question becomes: What happens when real product–market fit emerges in an ecosystem already full of users and capital?

In a sea of low-value meme, a real product would stand out like a firefly in the dark.

If Not Meme, Then What?

Memecoin will not disappear. But difficulty and risk are increasing rapidly. On Solana, memecoin lifecycles have shrunk: from Days to Hours.

So let’s get to the point. Future opportunities on Solana will likely revolve around its Internet Capital Market vision, which naturally brings focus back to DeFi.

Wherever there is a real problem that can be solved, there is opportunity.

Perpetual DEX: The Core Opportunity

When you compare Perp DEX on Solana to Hyperliquid’s tens of billions of dollars in daily volume, it becomes clear that the Perp segment on Solana is still very small.

The main reason lies in the limitation around prioritized cancels, as I’ve mentioned before. Meanwhile, leveraged trading is a non-negotiable component of this market.

With the BAM upgrade expected to roll out within the next 1-3 months, I expect Solana Perp DEX to enter a new wave of attention and gain meaningful traction in the near future.

At the moment, Jupiter accounts for roughly 76% of the Perp DEX market share on Solana. However, I don’t believe the Perp landscape on Solana is anywhere near settled.

Jupiter currently supports only three trading pairs: BTC, SOL, and ETH.

Drift Protocol, an OG project on Solana, is working closely with Jito to integrate BAM into its product, directly addressing the long-standing execution limitations.

Beyond that, a number of new projects are emerging in this space, some of which have not even launched their mainnet products yet.

Here is a list of projects currently building in the Solana Perp ecosystem: Saros, Bulk Trade (so potential), Tempo, Ranger Finance, Adrena, Flash Trade, Bullet (rebranded from Zeta).

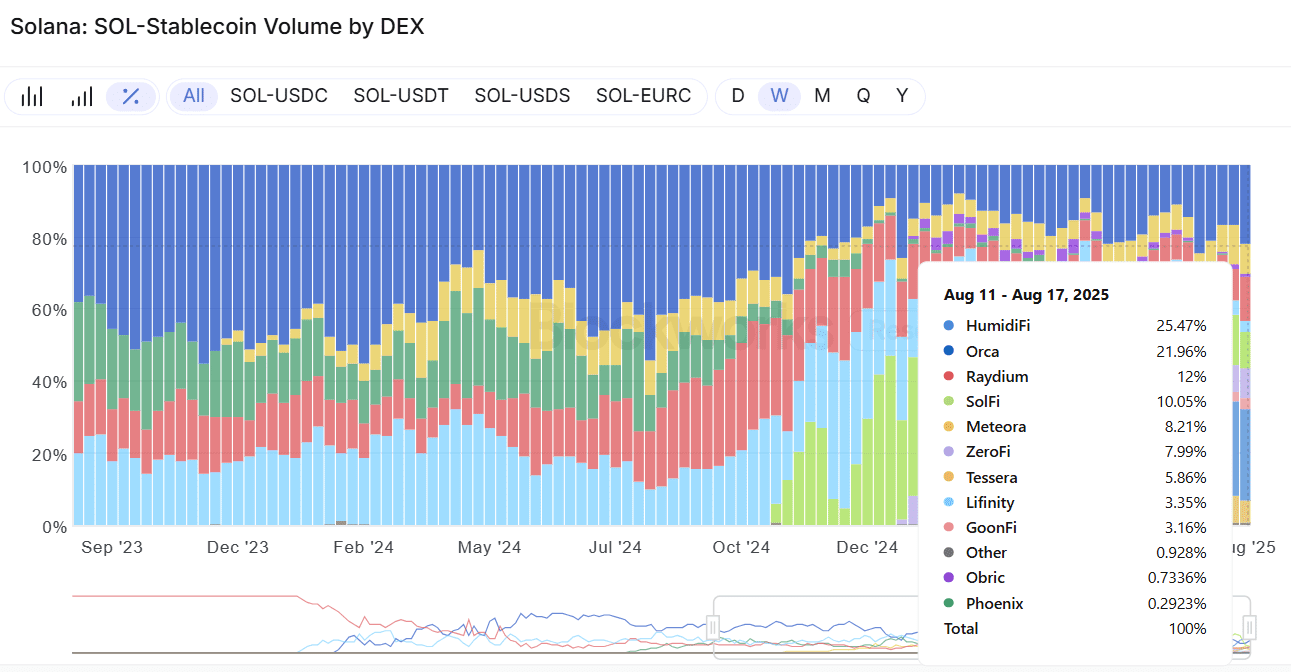

Spot DEX: Prop AMM Takes Over

Recently on Solana, a new DEX model has emerged called Prop AMM.

In this model, liquidity is provided by a single private entity, rather than through permissionless liquidity pools where anyone can supply capital, as has traditionally been the case.

This group now accounts for over 50% of total trading volume for high-liquidity pairs, primarily SOL/Stablecoin and Stablecoin-to-Stablecoin pairs.

As a relatively new category with significant volume share, Prop AMM is being viewed as a genuine innovation for DEX on Solana. However, at this stage, I don’t see a clear opportunity to invest, nor even a potential airdrop angle.

It’s also unclear whether these projects will ever launch tokens, as their operational model closely resembles that of an independent market maker, rather than a typical token-driven protocol.

Prop AMM do not offer a standalone user interface. The only way to interact with them is through DEX aggregators such as Jupiter or Titan.

Some notable projects in the Prop AMM category include: HumidiFi, SolFi, GoonFi, Tessera, ZeroFi, and Obric.

Looking ahead, it’s highly likely that the Solana DEX ecosystem will polarize into two distinct camps.

One side will be Prop AMM, serving high-liquidity assets. The other will be the traditional AMM, the “classic” model that has existed from the early days.

Within the Spot DEX segment, beyond Prop AMM, there are currently two newer and notable projects worth paying attention to: Titan Exchange and DeFiTuna.

I personally use Titan Exchange primarily for swaps on Solana.

As for DeFiTuna, while the ecosystem waits for the BAM mainnet upgrade to optimize CLOB-based mechanisms for DEX, DeFiTuna is offering a different approach. It leverages borrowed capital to increase available liquidity, providing the market with an alternative solution in the meantime.

Launched in late July, the DEX currently supports only three trading pairs, yet it has already captured around 6% market share, ranking fourth among AMM-based DEX.

Beyond that, another trend closely tied to the Internet Capital Market vision that’s worth paying attention to is Launchcoin Platforms.

Outside of PumpFun, BonkFun, and Believe App, two newer projects have recently emerged in this space: Gavel, Heaven and an OG with YC Combinator style - MetaDAO.

While most platforms in this category are leaning toward meme launching, Gavel, built by the Ellipsis team (an OG Solana team), is taking a different direction.

Instead of focusing purely on memecoin launches, Gavel aims to launch projects with real products. The team is building a platform designed to deliver the fairest possible token launches, with strong anti-bot mechanisms.

From my perspective, Gavel is clearly targeting the idea of bringing a more IPO-like environment on-chain, rather than simply facilitating speculative meme launches.

Notably, Gavel has been publicly shouted out by Toly on X, which is why I believe it’s a project that shouldn’t be ignored. It’s worth keeping an eye on which projects choose to launch on Gavel in the near future.

Can $SOL Really Go Higher?

I believe many of you reading this are SOL holder, just like me, so I want to share a few additional personal views on $SOL looking ahead.

The growth of the Solana ecosystem is one thing. But for $SOL to truly appreciate and by that I mean to rise strongly and faster than other coin, or more specifically to outperform $ETH and reverse this chart, it will require more than ecosystem growth alone.

The broader issue facing the market today is the lack of breakthrough products and ideas, the kind of genuinely new narratives that once fueled massive FOMO during the Altcoin season of 2021.

If you look at how $ETH has rallied strongly over the past month, you’ll notice that the momentum has come almost entirely from traditional financial institutions entering the market, rather than from the emergence of any new trend within the Ethereum ecosystem itself.

Because of this, I believe that institutional involvement or partnerships with major traditional players will play a critical role in pushing $SOL higher. Examples could include a Robinhood x Arbitrum–type partnership, or a Tom Lee moment, or a DAT-style catalyst.

Alternatively, Solana would need something even more disruptive. That could be the ecosystem where the first application reaches 50 to 100 million users, or a product that clearly outperforms the market in the way Uniswap, PumpFun, or Hyperliquid once did.

This, in my view, is the core bull case for $SOL. Only under these conditions does it become realistic for SOL to pivot the SOL/ETH chart and for expectations of $SOL reaching $1,000 to make sense.

Otherwise, $SOL is more likely to rise simply as part of the broader market trend. When that happens, price appreciation is typically much slower.

Final Note

This article does not call any trade.

IVY prioritizes understanding over signals.

You should always know why you are investing, not just what you are buying.

🖼 The Ivy NFT | Ivy NFT Holder Community:

→ X: @TheIvyNFT

→ NFT Collection: dagora.xyz/ivynft

📈 MarginATM | Trader Community:

→ X: @MarginATM

→ Telegram: t.me/marginatm

😎 Upside | Crypto Investor Community:

→ X: @gm_upside

→ Telegram: t.me/Coin98Insights

→ Tiktok: tiktok.com/@upsidevn

→ FB Group: fb.com/groups/Coin98.Net