“PERP DEX” Is Not a Short-Lived Trend

At the beginning of the year, I identified three major trends that I believed would define this cycle: DeFAI, Perp DEX, and Trading App. Two of them have already played out: DeFAI and Perp DEX.

More recently, another trend has started to enter the picture: Ownership / Futarchy.

The DeFAI sector resurfaced briefly through several launchpad waves on Virtuals. However, most of these projects still lacked anything particularly distinctive or true product–market fit. As a result, it was simply a second speculative wave that flared up and quickly faded.

As of now, I still don’t see any signals that suggest DeFAI is ready to return in a meaningful way.

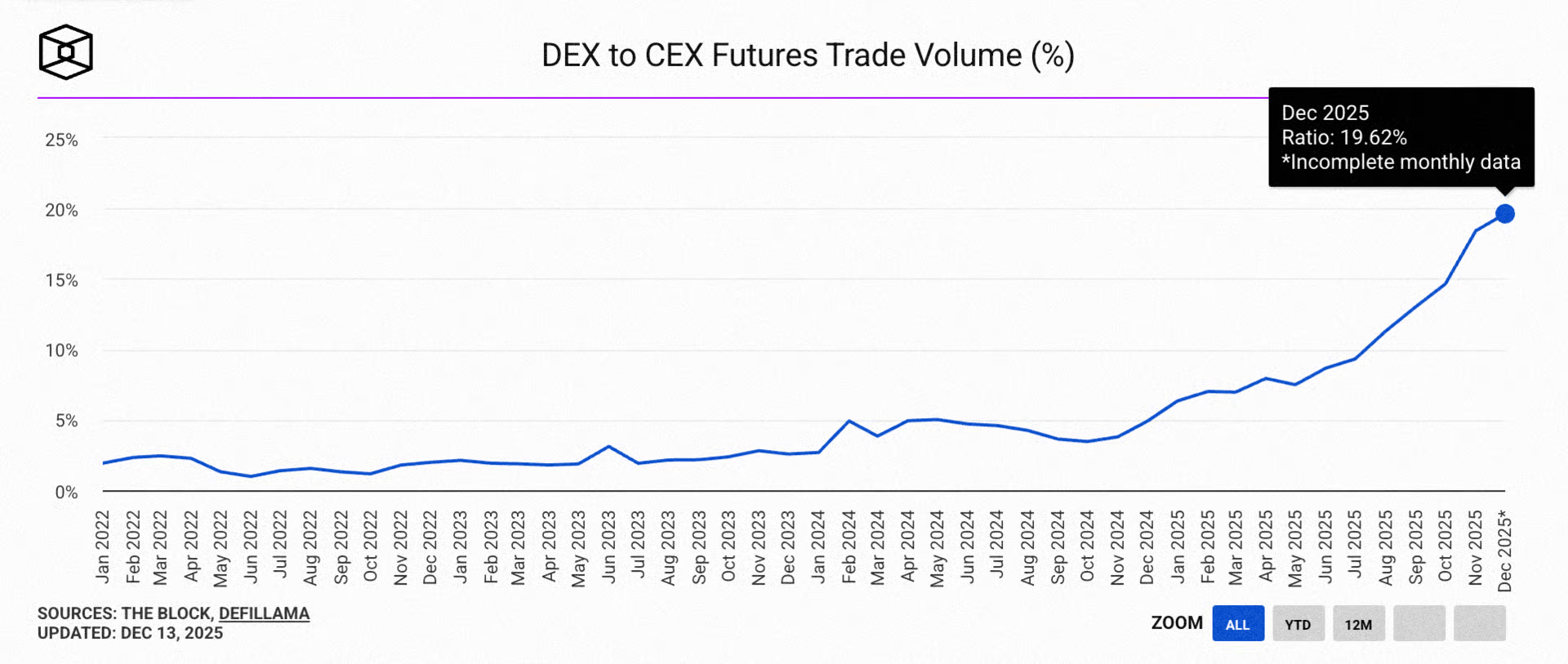

Perp DEX is a different story. At its core, Perp DEX offers Perpetual Futures Trading, a product that has already proven itself to be an essential market demand and a clear product–market fit within crypto.

The real challenge has always been this: Perpetual Futures Trading, but built on DeFi.

Historically, this was the biggest barrier preventing DeFi-based perpetual trading from delivering performance and user experience comparable to, or better than, centralized exchanges. That was the case until Hyperliquid appeared, proving that such performance was, in fact, achievable.

At this point, we can express the situation with a simple formula:

[An essential demand that hasn’t been fully satisfied] + [A new environment capable of serving it better and more efficiently] = [An inevitable long-term trend, rather than a temporary narrative]

This is why, even though Perp DEX recently surged strongly under Hyperliquid’s leadership, peaked when CZ officially stepped into the arena, and then cooled off after the October 11 crash, there is still more than enough reason to expect the Perp DEX trend to return.

Hyperliquid is currently the leading name in this segment. But that does not mean its position is guaranteed to remain unchallenged. Hyperliquid has its own set of problems to deal with. And it is precisely these problems that are creating room for new opportunities to emerge.

This article will not lead you directly to a buy or sell conclusion for $HYPE. It is still far too early to draw such conclusions, as the Perp DEX race has, in my view, only just begun.

Hyperliquid Is Still the Market Leader

From a market share and product maturity perspective, Hyperliquid remains the clear leader in the Perp DEX segment.

At its peak, Hyperliquid’s daily trading volume exceeded $40 billion, a level that was previously unthinkable for a decentralized perpetual exchange. Even after the market cooled following the October 11 crash, Hyperliquid still consistently maintains daily volumes in the tens of billions.

This confirms one important thing: real demand for on-chain perpetual trading already exists, and it is not small.

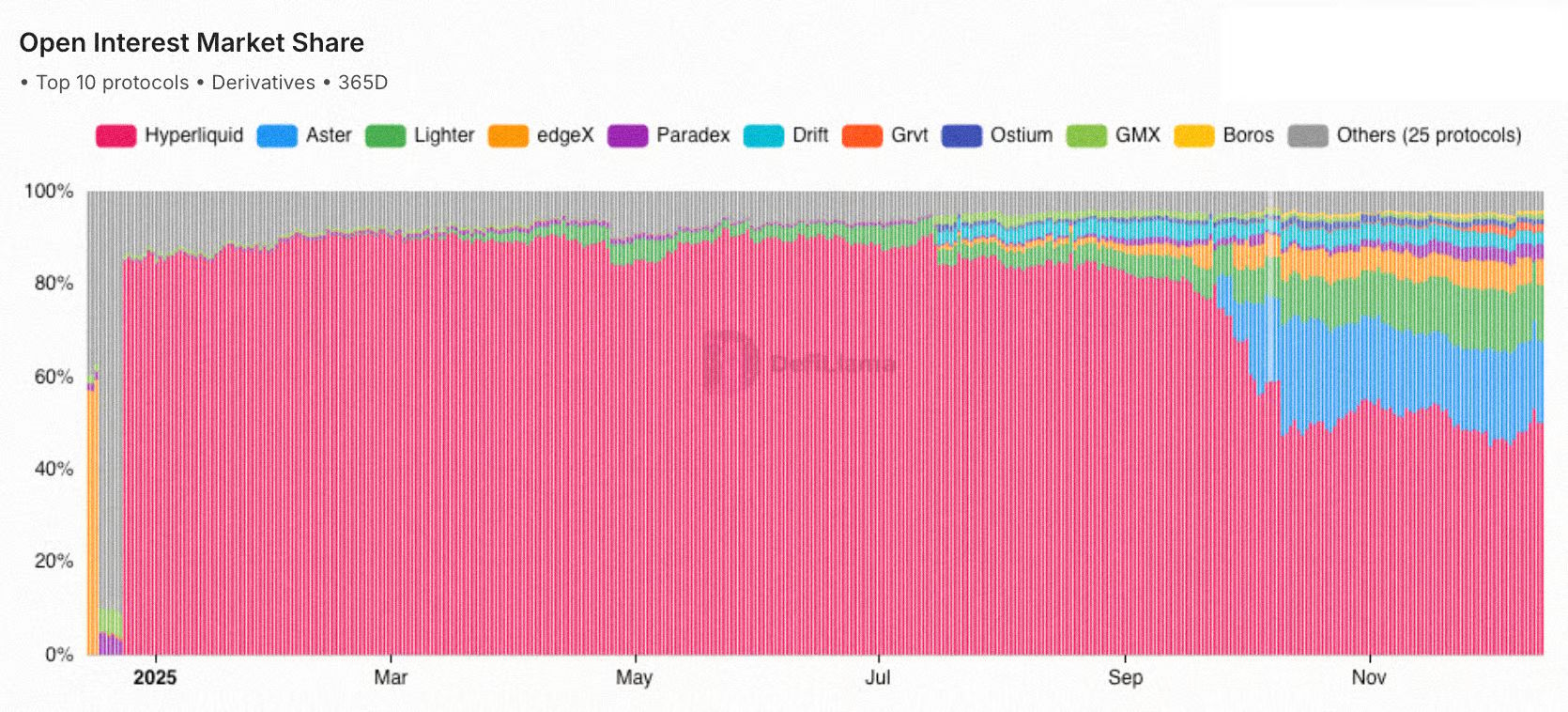

If we look at Open Interest (OI), Hyperliquid continues to dominate. OI is a more meaningful metric than volume, because it reflects capital that is actively committed to positions, rather than short-term trading churn.

Despite fluctuations, Hyperliquid’s OI remains significantly higher than that of any other Perp DEX. This indicates that traders are not only trading on Hyperliquid, but are also parking real capital there.

A Clearer Understanding of Hyperliquid’s Product Strengths:

While most competitors chose to build on an existing blockchain, where they have no ability to modify the underlying infrastructure, they were forced to rely on workarounds such as vAMM, “virtual” order books, or designs constrained by performance limitations.

Hyperliquid took a different path.

Instead of adapting to fixed constraints, Hyperliquid built its own chain, with infrastructure fully optimized for trading through HyperCore, bringing a real order book fully on-chain.

Liquidity is critically important. And when it comes to Perpetual Trading and leveraged trading, liquidity becomes even more essential. To achieve deep and reliable liquidity, the participation of Market Maker is non-negotiable.

Put simply, Hyperliquid succeeded in creating an environment where Market Maker are willing to place orders and provide liquidity with confidence, facing risk levels comparable to centralized exchanges.

This combination matters:

[Deep liquidity and high trading volume] + [No KYC] + [Decentralized] + [Transparent]

→ For the first time, a Perp DEX has managed to deliver all of these elements simultaneously. In that sense, Hyperliquid effectively won the market 1–0.

What Is Hyperliquid Facing?

Hyperliquid’s success is hard to deny. However, what Hyperliquid currently has represents only a snapshot of the present and the past. Investing, on the other hand, is about identifying expectations for the future.

Hyperliquid’s real edge lies in its strong product performance, but that does not automatically mean it will remain the best going forward.

This leads me to a key question: What are the weaknesses and challenges that Hyperliquid is currently facing?

The rapid price appreciation of $HYPE, combined with the platform attracting an increasing number of whales trading multi-million-dollar positions, has pushed the market to take Perp DEX seriously. As a result, participants have begun actively searching for “the next Hyperliquid.”

Several competing projects are now offering Perp trading environments with performance close to, or comparable to, Hyperliquid, while also layering in additional incentives such as zero trading fees and airdrop opportunities.

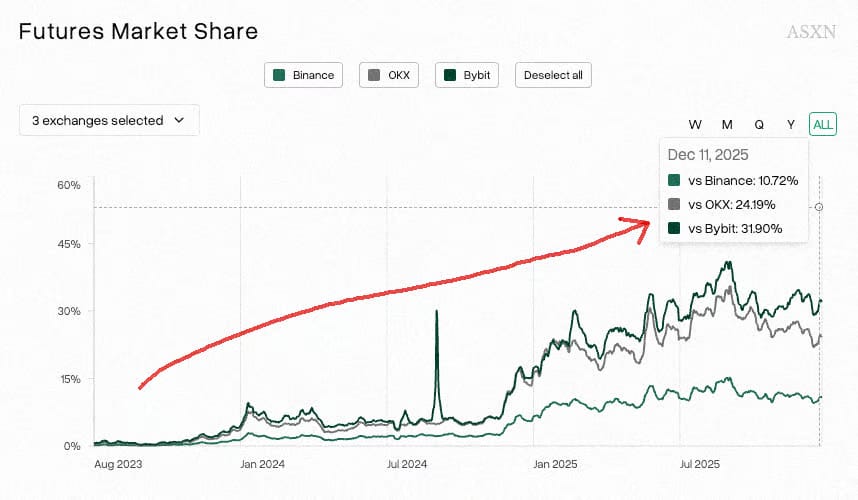

This has led to a noticeable decline in Hyperliquid’s market share.

Although Hyperliquid’s revenue remains relatively strong at around $10–20 million per week, rising competition clearly presents a major challenge that the platform must confront. Why?

One of the key drivers that pushed $HYPE to perform so well recently came down to two main factors:

Exceptionally strong revenue generation

Using 99% of that revenue to buy back tokens

In addition, there are several other factors to consider:

$HYPE is entering a phase with large token unlocks for the team.

Ongoing concerns and debates around the design of the automatic deleveraging mechanism.

The flagship product within the Hyperliquid ecosystem remains Perpetual Trading, while other DeFi activities or Spot Trading have yet to stand out.

When looking more broadly, Hype’s competitors are not limited to Light or Aster. Solana itself is also a competitor, as it is moving in the same direction of trading and capturing internet capital flows.

As a result, it is difficult to ignore the fact that Hyperliquid now faces more bearish factors than before. If Hyperliquid fails to maintain strong demand for Perp trading, then $HYPE entering a distribution phase after its sharp price appreciation becomes entirely plausible, while simultaneously opening the door for competitors to step in aggressively and overtake it.

Where Problems Create Opportunity

Given the challenges Hyperliquid is currently facing, I believe the platform is entering a phase where it needs to push much harder toward horizontal expansion, especially now that it already has all the core prerequisites in place:

Its core product is already operating well at a meaningful scale.

Hyperliquid has HyperEVM.

It has Builder Code.

Most importantly, it now has HIP-3.

Hyperliquid L1 itself is a blockchain purpose-built for trading, and its core product is Hyperliquid. Therefore, I believe the best opportunities will lie in products that directly help Hyperliquid grow, or that leverage the strengths and advantages Hyperliquid already possesses, rather than in basic primitives such as AMM, Bridge, Launchpad, or Lending.

Builder Code and HIP-3 are the two main tools the Hyperliquid team is using to accelerate horizontal expansion.

Builder Code functions similarly to an affiliate program. Developers can embed Hyperliquid entirely into their own products, customize the user interface to match their desired direction, and earn a share of trading fees generated on Hyperliquid.

Projects within the Builder Code program are mostly end-user–facing products. This allows Hyperliquid to indirectly reach new user segments that already exist across other platforms. From a growth perspective, this is a fairly solid expansion strategy.

However, over the long term, it could become less effective or even detrimental to Hyperliquid itself.

The reason is that many of these apps are essentially Perp DEX wrappers, and their distribution models resemble that of a Perpetual Aggregator, rather than creating unique, defensible value for Hyperliquid.

If Hyperliquid becomes overly dependent on the distribution power of these apps, that would clearly be a negative. That said, at the moment, these apps are not yet distinctive enough. Their interfaces and trading experiences are largely similar to trading directly on Hyperliquid, aside from a few that offer mobile app versions. Therefore, it is still too early to say that Hyperliquid is becoming dependent on them.

The Base project leading within the Builder Code category may benefit from airdrop expectations, as it is both something new and a project built natively on Hyperliquid. Personally, I have not yet formed a clear view on whether there is a compelling opportunity within this group.

HIP-3 is what I’m paying closer attention to.

Simply put, HIP-3 is an upgrade that allows any project staking 500,000 HYPE to create its own Perpetual market, built on Hyperliquid’s technology stack, charging trading fees and sharing a portion of that revenue with the Hyperliquid team.

→ This opens up opportunities for external teams to leverage Hyperliquid’s strengths to create new asset markets that the Hyperliquid team itself has not yet addressed.

Equity Perp (long/short on traditional stocks) is one area that some teams have already started exploring. Personally, I’m very interested in this segment within the broader Perpetual DEX trend, for several reasons that I’ve explained here.

Some Notable Names Within the HIP-3 Group Include:

TradeXYZ: Currently leading the Equity Perp segment on Hyperliquid. Built by the Unit team, a project that plays a critical role in bringing Spot lending to the Hyperliquid ecosystem. (I think it’s the most potential)

Felix: Initially focused on lending/borrowing and stablecoin, and more recently expanding into Perp trading for RWA, including stocks and commodities.

Ventuals: Conceptually, this project aims to enable long/short exposure to famous private companies that have not yet gone public, such as SpaceX and OpenAI. I currently view this segment as having low feasibility, mainly due to liquidity constraints. The core issue is the lack of real underlying assets to anchor value, making it difficult for market maker to hedge risk when providing liquidity. In that sense, this use case may be better suited to a Prediction Market model.

(You can explore more projects within the Hyperliquid ecosystem here)

Equity Perp is a promising segment because it offers something that traditional financial markets cannot easily provide. In addition, Perpetual Trading is a product that retail participants (small investors and traders) are already highly familiar with and actively trade.

However, there are still several major challenges that these projects must solve before this segment can truly scale and compete with other potential alternatives.

The core issue is liquidity.

Liquidity across Equity Perp products, both at the market level and within the HIP-3 ecosystem, remains low.

For market maker to participate and provide liquidity, they must be able to hedge their Perpetual positions against the underlying assets they are quoting to traders.

There are also oracle and latency risks. Because there is no direct Equity Spot asset on the Hyperliquid chain, market maker face significantly higher risk when providing liquidity, especially compared to traditional markets. This risk is even more pronounced during weekends, when traditional markets are closed for two days.

In this regard, Solana currently has a clearer advantage, as xStock has already brought equities on-chain.

Solving this problem means solving liquidity and funding rate efficiency, and potentially enabling higher leverage, which would attract more traders to participate.

Using Tesla stock as an example, the same underlying asset shows a 23.6% funding rate on TradeXYZ, while on Felix it is only 4.46%.

Although both projects use Hyperliquid’s technology through HIP-3, the outcomes differ significantly due to choices around setup, fee structure, oracle providers, pricing rules when traditional markets are closed, liquidity coordination, and risk management at the protocol level.

All of these factors have a direct impact on user experience and ultimately determine the success or failure of a project.

Whoever solves this problem more effectively will clearly be a key name worth paying attention to.

You may have heard the name Hyperliquid frequently in recent months, along with many stories about its success. However, when you take a closer look, everything surrounding the Hyperliquid ecosystem is still very early-stage.

If we go back to what Jeff once stated, the goal of building Hyperliquid was to become “the home of global finance”. Put simply, a central hub for liquidity across assets and financial activity, or what could be described as the “AWS of Liquidity.”

Viewed through that lens, what exists around Hyperliquid today is still highly nascent.

Most notable projects within the Hyperliquid ecosystem do not yet have tokens, which means that using the products themselves is currently the only way to gain exposure to potential opportunities.

If you believe Hyperliquid will continue to grow, or that the team will need to accelerate horizontal ecosystem expansion even further, then the points outlined above represent everything most worth understanding and paying attention to within this ecosystem right now.

🖼 The Ivy NFT | Ivy NFT Holder Community:

→ X: @TheIvyNFT

→ NFT Collection: dagora.xyz/ivynft

📈 MarginATM | Trader Community:

→ X: @MarginATM

→ Telegram: t.me/marginatm

😎 Upside | Crypto Investor Community:

→ X: @gm_upside

→ Telegram: t.me/Coin98Insights

→ Tiktok: tiktok.com/@upsidevn

→ FB Group: fb.com/groups/Coin98.Net